News - Corporate

Embraer EARNINGS RESULTS – 3rd Quarter 2025

November 04, 2025

HIGHLIGHTS

2025 Guidance reiterated. From an operations point of view, the company estimates Commercial Aviation Executive Aviation deliveries between 77 and 85 aircraft, and deliveries between 145 and 155 aircraft. From a financial point of view, revenues in the US$7.0 to US$7.5 billion range, adjusted EBIT margin between 7.5% and 8.3%, and adjusted free cash flow of US$200 million or higher for the year.

S&P upgraded our credit rating from “BBB-” to “BBB” (2 notches above IG threshold) and, in addition, Fitch Ratings and Moody’s revised their outlook for the company from stable to positive (“BBB-” and “Baa3” ratings or 1 notch above IG threshold).

Revenues totaled US$2,004 million in 3Q25 – all-time high 3rd quarter – +18% yoy. Highlights for Commercial Aviation and Defense & Security revenues with +31% and +27% yoy growth.

Adjusted EBIT reached US$172.0 million with an +8.6% margin in 3Q25 (+17.6% in 3Q24; +8.7% ex Boeing agreement). U.S. import tariffs totaled US$17 million during the quarter (85bp); US$27 million year-to-date.

Adjusted free cash flow w/o Eve was US$300.3 million during the period because of higher number of aircraft delivered and lower accounts receivables.

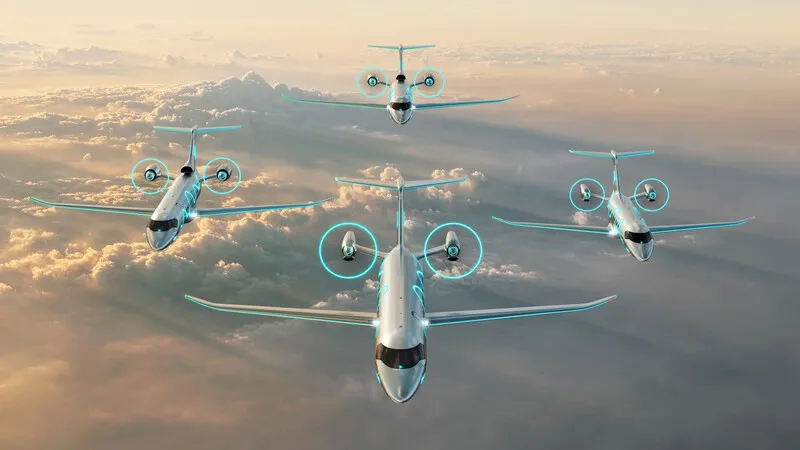

Embraer delivered 62 aircraft in 3Q25, of which 20 were commercial jets (13 E2s and 7 E1s), 41 were executive jets (23 light and 18 medium) while 1 was defense (KC-390 Millennium); +5% versus 59 aircraft delivered yoy.

Firm order backlog of US$31.3 billion in 3Q25 – an all-time high.For more information about the 3Q2025 backlog check 3Q25 Backlog and Deliveries release.

Click download to read the full document.

Follow us on X: @embraer

View all sections

View all sections

Reset

Reset

CLOSE

CLOSE