News - Commercial Aviation

Embraer China Market Report Identifies New Paths to Profitability for Chinese Carriers

November 14, 2025

• Identifies untapped “Blue Ocean” market as a strategic path to restore pricing power

• Launched during Embraer Business Seminar 2025, presenting key conclusions to senior airline executives and industry stakeholders

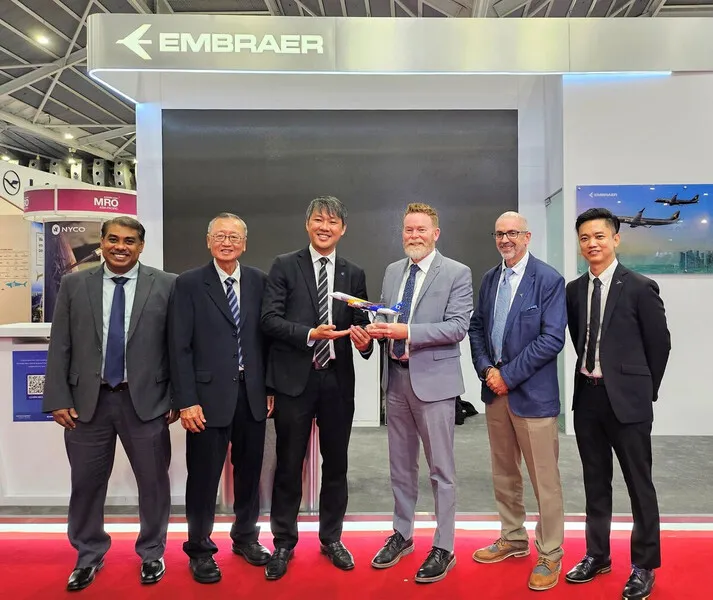

Huizhou, China, November 14, 2025 – Embraer (NYSE: EMBJ / B3: EMBJ3) today released a pivotal market report, “A New Course for Profitability in China's Aviation Market,” during the Embraer Airline Business Seminar China 2025, in Huizhou. The report goes beyond simply diagnosing the well-known challenge of intense competition between airlines by providing a strategic framework for Chinese airlines to achieve sustainable profitability.

“The recovery in passenger numbers has proven China’s market potential, but it’s clear that volume alone cannot restore airline profitability,” said Patrick Peng, Managing Director of Embraer China. “Our analysis shows that the future of profitability lies in operational excellence and strategic choices. It hinges on a combination of pricing power, targeted expansion into ‘blue ocean’ markets, and fleet differentiation with right-sized aircraft. Carriers that master this strategic approach will be the ones to transform China’s immense traffic growth into durable financial success.”

The report characterizes these over-served, highly competitive routes where airlines fight for share on the same major city pairs as the “Red Ocean”, a market environment defined by fierce competition, pricing pressure, and diminishing returns. In contrast to the “Red Ocean”, the report identifies these underserved and structurally advantageous markets as the “Blue Ocean”, segments with lower competitive intensity that offer airlines the potential to create new demand, secure price power, and achieve stronger profitability.

Key Findings of China Market Report:

• “Red Ocean” Competition Severely Limits Airline Profitability: The heavy concentration of capacity on high-density trunk routes has led to overlapping services and intense homogenization of offerings. This environment triggers persistent fare wars, which in turn severely compress airlines’ profit margins, making profitable growth in these saturated markets increasingly difficult.

• Revenue Matters More than Scale: Analysis reveals that levers such as average fare and load factor have a greater impact on margin outcomes than incremental cost savings. The common tactic of lowering fares to stimulate passenger volume and to gain market share is, therefore, counterproductive and directly destroys profitability.

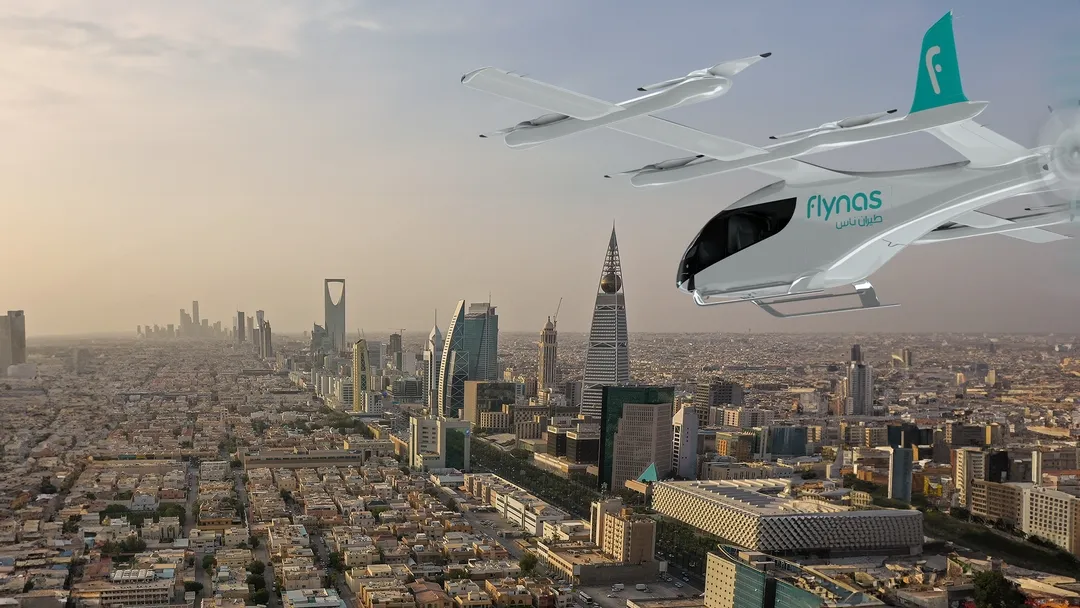

• Blue Ocean Markets are Key to Restoring Pricing Power: Significant opportunities exist beyond the trunk routes. Underserved Tier 2, 3, and 4 cities, city pairs not parallel to high-speed railways, short-haul international links, and secondary point-to-point routes often present monopoly or duopoly market opportunities. This structural advantage allows carriers to secure price power, protect yields, and achieve sustainably higher returns.

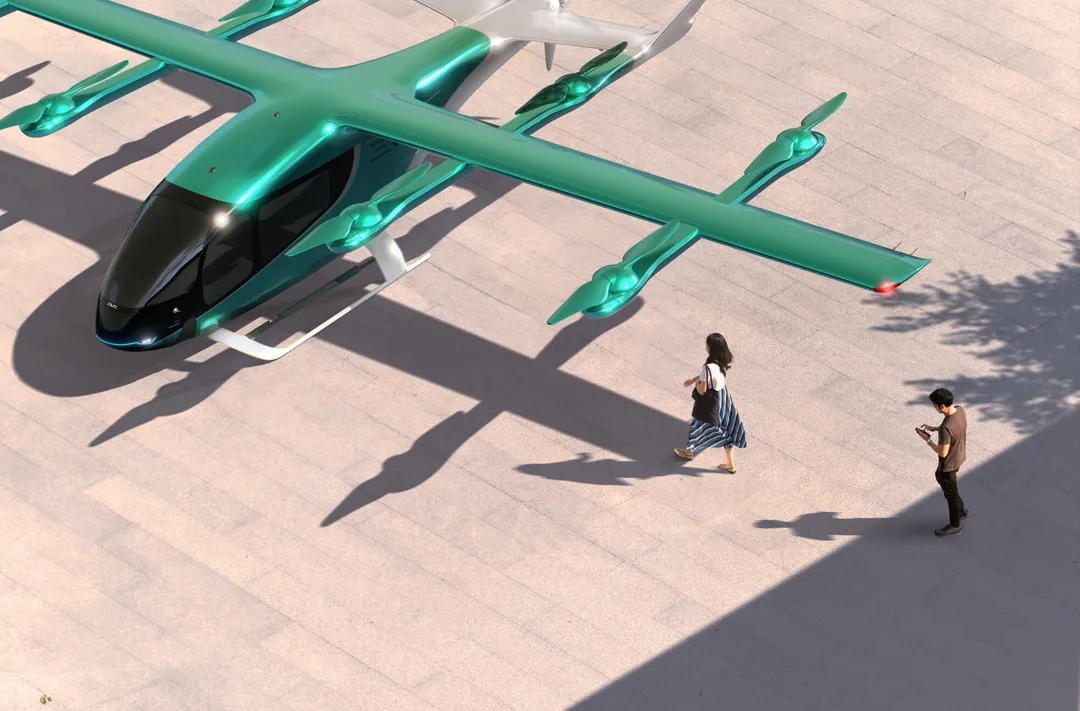

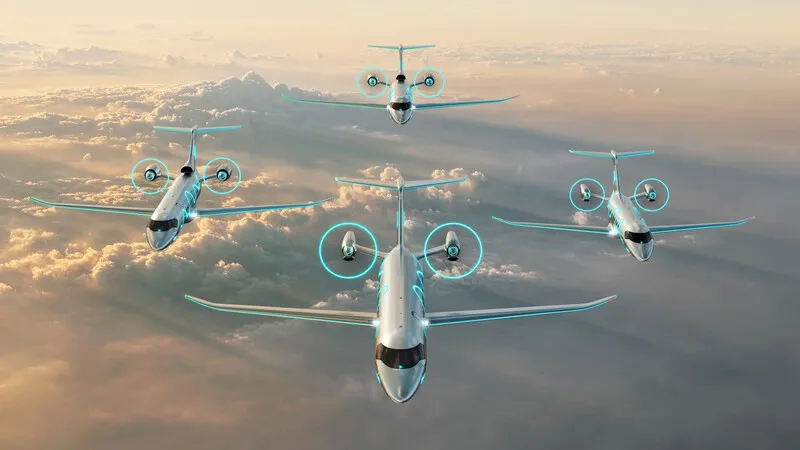

• Fleet Right-Sizing is Fundamental for Profitability: Integrating new-generation small narrow-body and regional jets enables a more optimized operational strategy. These aircraft allow for increased flight frequency without over-capacity, which helps protect yields. They also deliver significant reductions in major costs like fuel, maintenance and ownership, effectively converting passenger traffic into profit rather than merely expanding volume.

The report was unveiled at the Embraer Business Seminar China 2025, hosted by Embraer in Huizhou City on November 13. The event convened senior executives from domestic and international airlines, industry experts, and leaders from aviation associations, consulting firms, and financial institutions. The event served as a critical platform to discuss strategic development and new pathways for the civil aviation industry as it navigates challenges including intensified competition and the impact of high-speed railway.

Download the complete Embraer China Market Report at:

https://embraer.imagerelay.com/share/379dc6a22a504a3cafdcfe8bd1f9256a

About Embraer

Embraer is a global aerospace company headquartered in Brazil, with businesses in Commercial and Executive Aviation, Defense and Security, and Agricultural Aviation. The company designs, develops, manufactures, and markets aircraft and systems, providing comprehensive after-sales services and support.

Since its founding in 1969, Embraer has delivered over 9,000 aircraft. On average, one Embraer-manufactured aircraft takes off every 10 seconds somewhere in the world, transporting over 150 million passengers annually.

Embraer is the leading manufacturer of commercial jets with up to 150 seats and the top exporter of high-value-added goods in Brazil. The company maintains industrial units, offices, service, and parts distribution centers across the Americas, Africa, Asia, and Europe.

View all sections

View all sections

Reset

Reset

CLOSE

CLOSE