We’ve just ended the first five months of the year by adding five new E-Jet E2 customers who will deploy their airplanes on a range of missions. Their acquisitions showcase the true versatility of the E2s across Europe, the Middle East and Asia.

Airlines were quick to purge older, less fuel-efficient aircraft during the pandemic. Now, they’re rebuilding their fleets with newer equipment that is focused on developing better network connectivity, reducing fuel consumption, and achieving net zero emissions goals. Our E2s fit the bill – they burn less fuel and already meet ICAO’s strict future NOX and CO2 emissions limits.

Our new customers will use their E2s in four different ways. In low-cost carrier environments, Salam Air, a low-fare airline from Oman, and Singapore’s Scoot will grow their current LCC networks with the E195-E2. TUI, a Belgian charter operator, will fly its E195-E2s from Antwerp to serve new holiday destinations from northern Belgium. Royal Jordanian, a 15-year E-Jet customer, will add E190-E2s and E195-E2s for mainline service within the Levant. And Malaysia’s SKS Airways will start regional flights to/from Kuala’s Lumpur’s downtown Subang Airport.

The E2s were designed to complement existing narrow-body frequencies, open new markets, serve noise restricted and short-runway inner-city airports, fly long range, and with operating economics that make them ideal for highly competitive, low-fare environments.

As carriers shop for new airplanes, many are only now discovering the tremendous potential of the E2s. Together with our leasing partners, we’re eager to build on this new awareness and to confirm more customers for the world’s most sustainable airplanes in the next half of the year, so stay tuned.

We recently announced 64 commercial aircraft deliveries for 2023. This is one unit short of our planned 65 to 70 target but it’s still 12% more than 2022. While I’m pleased with the upward trend, our goal is to return to around 90 annual deliveries which we achieved in 2018 and 2019. And although the 2023 revenue was nearly the same as 2019, we’re still only at 70% of pre-pandemic output.

Here is why I’m confident we’ll get back on track in the near term.

Supply Chain

The engine delay issue is being resolved. We’re working with our suppliers to ensure they deliver what we commit to the market. We could have delivered more aircraft but we have to work within the limits of our planning cycle. There’s still room for improvement, particularly with faster shipment of supplies to the production line.

I’m encouraged by the quality of the Pratt & Whitney GTF engines for our E2s now coming out of the factory. They are good to go, with full LLP life and no further need for powder-metal parts inspections. There is a group of older aircraft in the world fleet that will need shop visits but overall, we will be less impacted than other platforms because the E2 had more improvements built-in since it’s EIS. Also keep in mind that the E2s are lighter and don’t generate as much wear and tear on the engines.

2024 Forecast

For 2024, our delivery numbers will be based on what our suppliers can realistically furnish. Our production processes are closely aligned. We’re working with them to grow this year’s output target by double digits. We’re in constant communication with them to make sure we’re on track. I expect to announce the number in the next few weeks.

New E2 Opportunities

No doubt you’ve been following the tremendous performance of the E195-E2 with Canada’s Porter Airlines, which plans to have a fleet of 75 E2s. The company has expanded to the USA with flights to destinations in California and Florida. It will start flying to Las Vegas next month and is eying new service to cities in 8 more states.

Porter gives tremendous visibility to the E2 in the huge USA market. Airlines there are starting to appreciate the range capability of the airplane family, especially the larger E195-E2. The E2 is already generating more conversations with our North American customers but it will take a bit of time to build greater awareness.

One sticking point is the pilot shortage. Fewer available pilots favours interest in bigger narrowbodies, and that creates a gap between those aircraft and the regional fleet. There have been a few soft years but the shortage seems to be resolving itself. That implies that we’ll see more demand for smaller narrowbodies which should fill in that gap. In the meantime, orders for the E175 in the USA remain strong since there isn’t movement on pilot scope clauses.

There are also new opportunities in Asia now that the E190-E2 and E195-E2 are certified in China. The E190-E2’s capacity fits nicely in the middle of the Chinese product line – the ARJ21 at the lower end and the C919 at the top end. Plus, it has excellent hot and high performance since China has many high-altitude airfields. We took the E190-E2 to Lhasa to prove its capabilities in extreme conditions. The E2 is a great aircraft to connect Greater China from west to east, too. We have a lot of customer engagements, but developing the market takes patience.

A new Asian customer will also raise the visibility of the E2 in that region. In a few weeks, we’re delivering the first of 9 E190-E2s to Scoot, a Singapore Airlines subsidiary. Scoot will be a great showcase for flying the aircraft in a low-fare business model.

More Innovations

We rolled out our first E190F passenger-to-freighter conversion last November. We’re finalizing that aircraft right now and expect the first flight by mid-year with certification shortly after. The next step is to work on the larger E195F.

Demand for cargo has softened since we launched our P2F program. But you need to build when the market is a bit slow so you’re ready when demand comes back. There’s so much opportunity for an E-Jet sized freighter, especially with the boom in e-commerce and the need for faster shipments to smaller markets. Until now, there’s no cargo aircraft that fits between an ATR and larger narrowbodies.

People often ask me about the status of our new-generation turboprop. We paused development of the concept in 2022 simply because we didn’t have an engine for it at the time. We still don’t have one so we’ve assigned some of those resources to our Energia program. The focus now is on exploring new propulsion technologies – electric, hybrid-electric, and hydrogen – in the up-to-50 seat segment. Our progress with our Energia initiative may determine how we proceed with a new turboprop.

Our E2s just keep getting better! We now have approval from ANAC, Brazil’s aviation regulatory authority, to fly the E190-E2 and E195-E2 under ETOPS 120 rules. This doubles the 60-minute ETOPS limit under which the aircraft were previously operating.

We had hoped to get the approval earlier, but we needed more time to accrue the 125,000 flight hours of field data required by FAA Title 14 CFR Part 25 Appendix K, which governs Extended Twin Engine Operations. It took us longer to accumulate the worldwide E2 fleet flight hours because airlines had reduced their schedules during the pandemic. We expect ETOPS 120 certification from the FAA and EASA in the coming months. Those approvals typically follow ANAC.

What is ETOPS?

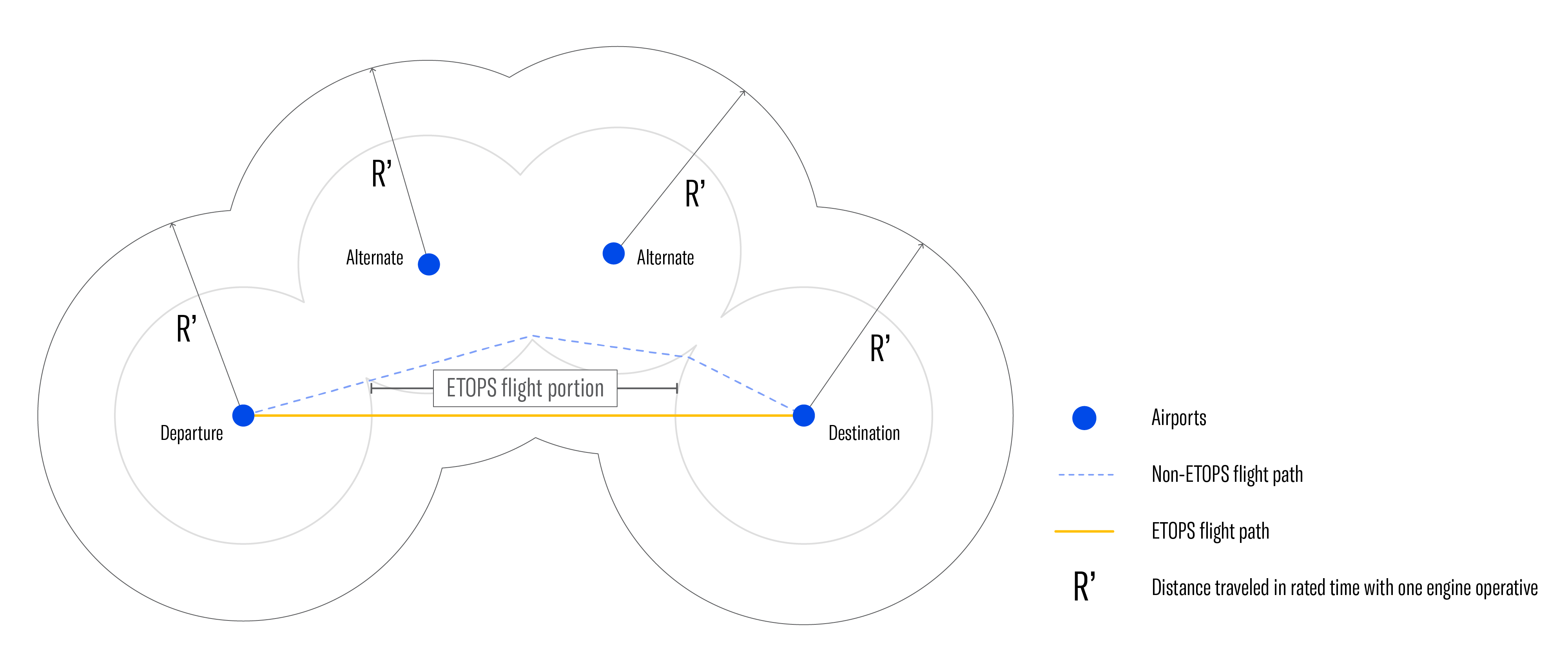

If you aren’t familiar with ETOPS, it’s an ICAO acronym for twin-engine aircraft flying further than one hour from a diversion airport with one engine inoperative at cruise speed over water or remote land. Now, with ETOPS 120, that diversion time is extended to two hours. Each E2 had some modifications. For example, the cargo fire suppression system was redesigned to comply with the longer diversion time. In fact, the E2s exceed the certification requirements by 15 minutes.

New benefits for our E2 customers.

Airlines wanting to fly their E2s on routes where there are few or no 60-minute alternates, such as over vast deserts like the Sahara or forests like the Amazon, will really benefit from ETOPS 120 certification. Longer overwater sectors are now possible, too. This is particularly attractive in the Asia Pacific region. Simply put, E2 operators can now fly routes that are two hours from a diversion airport. That means airways distance is shorter. And a shorter sector saves time, fuel, and money. Routes that were once unattractive or operationally not viable are now feasible. This opens the door to new nonstop services.

Here’s a graphic that shows the straight line, shorter-distance flight path under ETOPS.

ETOPS 120 is yet another example of how we’re continually improving the E2 experience for our customers and their passengers.

There are 3,000 small narrow-body (NB) aircraft flying today, with many airlines looking to replace these aircraft in the next few years. Choosing which new aircraft to introduce into a fleet is determined by three main factors – aircraft economics, passenger demand and operational model. The latest generation of small NB aircraft, like the Embraer E-Jets E2, offer airlines unique features and capabilities.

New Opportunities

Despite weaknesses in the global economy, there is no let-up in people’s desire to travel. However, the flow of people has changed after the pandemic, and with the rapid growth of secondary and tertiary airports (reflecting the change in work patterns post Covid), airlines are now assessing the ability to launch routes to smaller city airports, while, at the same time, connecting communities and businesses in more remote locations.

Taking into consideration these challenges, small NBs, carrying between 70 and 150 passengers and flying routes up to 6 hours, give airlines greater flexibility, complementing larger aircraft for low-density operations. The E2 family is the perfect fit for this scenario and adds a tremendous economic benefit by offering a similar cost per seat to a larger NB, but with higher profitability.

Superior comfort and space

Larger NBs are popular due to their lower cost per seat, but typically, passengers do not report a comfortable experience. This is mainly because of the six-abreast configuration and tight seats – the person unlucky enough to be sitting in the middle seat being squeezed. Previous generations of small NBs had a similar cabin design as larger NBs and inherited the same cabin experience. The arrival of new aircraft like Embraer’s E2 has transformed this. The lowest noise levels of any new generation jet, the E2’s 2+2 seating with no middle seat and wider aisle gives passengers a much better experience, providing the feeling of control of their own space, further enhanced by the larger overhead bin that provides space for every passenger’s carry-on luggage. The wide aisle also helps airline operations, speeding up the boarding and deplaning process, resulting in quicker turnarounds.

All-round sustainability

Alongside providing customers with a more comfortable cabin experience, airlines are also seeking ways to reduce their carbon emissions and meet ESG/sustainability goals. Small NB aircraft provide the ideal solution. Take the E2. Because of the introduction of new engines, an improvement in aerodynamics, and its short runway landing capability, the E2 achieves a 25%* reduction in fuel burn and emissions, the lowest CO2 emissions of any new generation jet. Equally impressive is the E2’s transition to alternative fuels with 100% SAF compatibility by 2028.

As airlines look to the future, day-to-day challenges remain. These include high fuel and maintenance costs as well as rising airport taxes and fees. Consequently, there is an urgent need by operators for new aircraft, and already in 2024, we are seeing a marked increase in small NB orders. No other platform can match the combination of outstanding efficiencies, lowest emissions, superior comfort, and unbeatable economics – key considerations for airlines seeking a return on their investment, network expansion, and accelerated opportunity.

* compared to first generation E-Jets.

CLOSE

CLOSE